The eRoutingNumber™ database uses many different sources and has evolved since 1998, and now makes use of user reporting to keep the data in check. Any consumer can report a routing number lacking, invalid, or present particulars not included. This info might include hyperlinks or references to third-party assets or content. We don’t endorse the third-party or guarantee the accuracy of this third-party info. The GlobalBanks editorial group comprises a bunch of subject-matter consultants from throughout the banking world, together with former bankers, analysts, traders, and entrepreneurs.

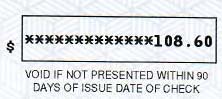

Managing stale-dated checks requires cautious attention to authorized issues to keep away from unfavorable penalties. It is necessary to understand the statute of limitations, adjust to unclaimed property laws, prevent fraudulent checks, and adhere to the Negotiable Instruments Regulation. By staying knowledgeable and taking proactive measures, companies and people can effectively https://www.intuit-payroll.org/ manage stale-dated checks and keep away from authorized and financial issues. Stale-dated checks can have a major impact on each the issuer and the recipient of the verify.

We’re the Client Financial Protection Bureau (CFPB), a U.S. authorities agency that makes positive banks, lenders, and other monetary corporations deal with you pretty. In fact, GlobalBanks IQ even helps non-resident, foreign & offshore entities open bank accounts. – If you’re the one who wrote the verify and it has but to be cashed, examine with the recipient to see in the event that they nonetheless plan to money it. – Contact the one that wrote the check and ask in the event that they can provide you a brand new one.

Adverse Account Steadiness

- We don’t endorse the third-party or guarantee the accuracy of this third-party information.

- Insurance Policies vary by institution, so contact the issuing financial institution for specific pointers.

- You should deal with invoice funds, clear debts, and ensure well timed worker fee.

- However, an individual could now not be succesful of deposit or money a examine after it has become stale.

- Nevertheless, when you miss the expiration date on a government-issued verify, don’t be concerned.

- If you find an expired examine, your first action must be to call each your bank and the issuing financial institution to find out about their insurance policies.

If you could have additional questions you want to ask our staff, don’t hesitate to get in contact. Legal fees often characterize a good portion of the expenses incurred throughout authorized proceedings,… When we speak about dividends, we’re normally referring to the payments a company makes to its…

Nevertheless, dealing with physical checks poses a problem – keeping observe of their whereabouts. They can simply be misplaced or accidentally discarded with other waste. Shedding a check or delaying its deposit may find yourself in it becoming stale-dated. Stale dated checks could be a downside for both the issuer and the holder, as they will lead to bounced checks and disputes over payment.

Set Up Clear Fee Phrases With Shoppers And Vendors

The Routing Number is a 9-digit quantity situated between the Transit Symbols at the bottom of a valid U.S. verify. Routing Quantity Outcomes are Up To Date Daily from the eRoutingNumber™ Database. This database includes unique knowledge, not offered by different sources, like Pretend Routing Numbers, and the Fraction Code or Fractional Routing Number found on the face of printed checks..

Having a bookkeeper or accountant in the group could be a great assist to the employer. To have sound information about stale-dated checks, the employer should have a good concept about how to discover out if the check has turned stale. As a results of the difference in the state guidelines, the time required for a verify to become stale also varies for the various states in the U.S. Therefore, as per the out there information, the verify could be considered stale if not cashed in the bank within 60 days or it’d by no means be thought-about stale. From the angle of the issuer, stale-dated checks could be a source of frustration and confusion. They can create a mismatch between the amount of money that the issuer thinks they’ve and the precise quantity that is obtainable in their account.

To forestall this, keep away from post-dated checks and opt for electronic funds or different cost options. One way to stop stale-dated checks is to request electronic funds. Many corporations now provide digital payment choices, such as direct deposit or on-line payment systems. This could be a convenient approach to obtain funds quickly and securely.

In the case of stale-dated checks, the statute of limitations varies from state to state. After this time period, the verify turns into void, and the issuer is now not obligated to honor it. Nevertheless, it is essential to note that the statute of limitations may be prolonged if the examine has been reissued or if the issuer has acknowledged the debt in writing. Accepting stale-dated checks can be dangerous and should be approached with caution. It is necessary to focus on the dangers of insufficient funds and fraud, as nicely as the choices for managing stale-dated checks.

Some checks have preprinted language stating how lengthy they’re valid. Learn how to use checks for personal checking accounts, together with types, advantages, and greatest practices for managing your funds efficiently. Accepting stale-dated checks can be a recipe for catastrophe, as it exposes both the payer and the payee to varied risks. One of the primary risks is the chance of insufficient funds, which can lead to bounced checks and overdraft charges. Banks can even enhance their processes to keep away from banking errors and guarantee well timed processing of checks. Stale-dated checks is usually a actual headache, and it is important to grasp the causes and risks concerned.

The possibility of clearance of the enterprise amount lies with the financial institution itself. You acquired a paycheck out of your employer two months in the past, however you didn’t deposit it because you were out of town and did not have entry to your checking account. When you finally try to deposit the verify, you may be informed that it is stale-dated and cannot be cashed. In this case, you would need to contact your employer and ask them to issue a model new examine. A stale-dated examine is a examine that has not been cashed or deposited inside a sure time period, usually round six months.